Why is it so hard to get transparent SaaS pricing?

Joel Windels | MAY 13, 2022

Subscriptions have become an unavoidable part of our purchasing behavior. DVDs and CDs have been replaced by Netflix and Spotify, and the ownership economy has been almost entirely consumed by the sharing economy. Why purchase a car that will spend most of its time parked in your driveway when you could pay for one only in the moments you need it? The same goes for socks, toothpaste and even underwear. Similarly, business software has largely followed the same march towards subscription models, with Gartner expecting the size of the overall SaaS market to reach $176 billion by 2023.

Today, organizations mostly subscribe to business software in the cloud, which is easier to deploy and supports scalability with much more agility than with perpetual pricing models. Yet this revolution in software has also brought new challenges to overcome, and spiraling costs are chief among them. A significant cause of these growing expenses is the widespread opacity of pricing, with information often extremely hard to get hold of. It’s no secret that SaaS suffers from a serious lack of pricing transparency — but why? And what can be done about it?

Where is vendor pricing available?

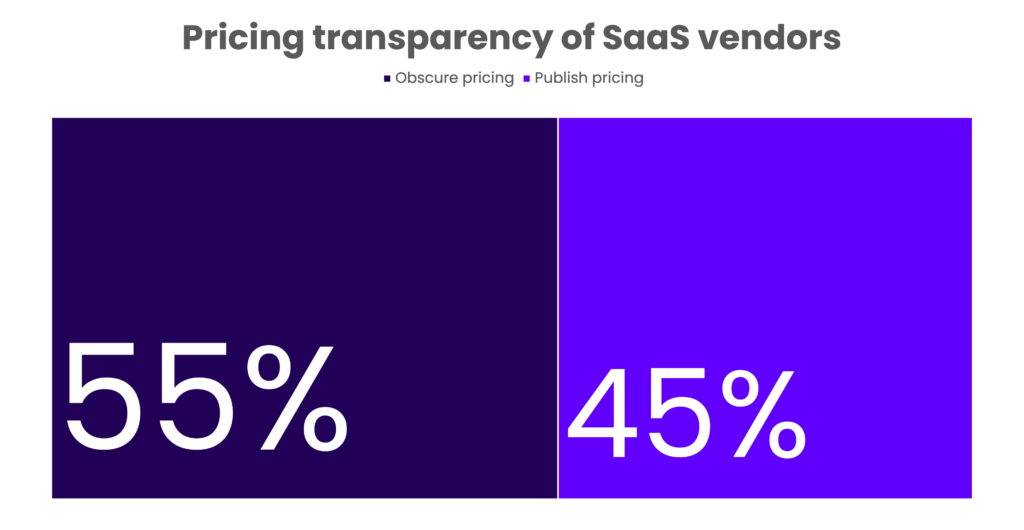

Trends come and go in the SaaS space, and pricing is no different. Some vendors publish their pricing, either directly on their website or through third parties — like resellers or public cloud listings. Frustratingly though, more often than not software companies deliberately obscure their pricing. Research from Openview suggests that only 45% of SaaS vendors display pricing online, while the remaining 55% keep it hidden from potential prospects.

This lack of visibility into the cost of software can make the purchasing process a genuine challenge. Scraping information from feature comparison sites like G2 and Gartner Peer Insights is one method, but data is often fragmented and unreliable. In some countries, such as the UK, vendors have to include pricing information to pass the verification required to appear on G Cloud and sell into the public sector. When all else fails, there is often an anecdotal reference to a vendor’s pricing on a buried Reddit thread or forum post from the mid 2000s.

So why is it so difficult to find out how much this software actually costs?

SaaS vendors don’t want you to know

There are a number of reasons that SaaS vendors would rather you speak with them directly rather than shop around. In the kindest light, this is so that vendors can match pricing to the unique needs of each customer or prevent arbitrage between different regions. It may also be to better support sophisticated, complex sales cycles in highly technical product categories. The reality in most cases, however, is that obfuscating pricing works to the advantage of the vendor.

Austin Petersmith, founder and CEO at Racket, explains this situation eloquently: ”If the negotiation happens in a silo entirely controlled by the vendor, then that framing could be vastly different from what everyone else is paying. This makes a huge difference. Sales teams know that people love to feel like they got a great deal, but they are happy to admit that this can be accomplished regardless of the starting point.”

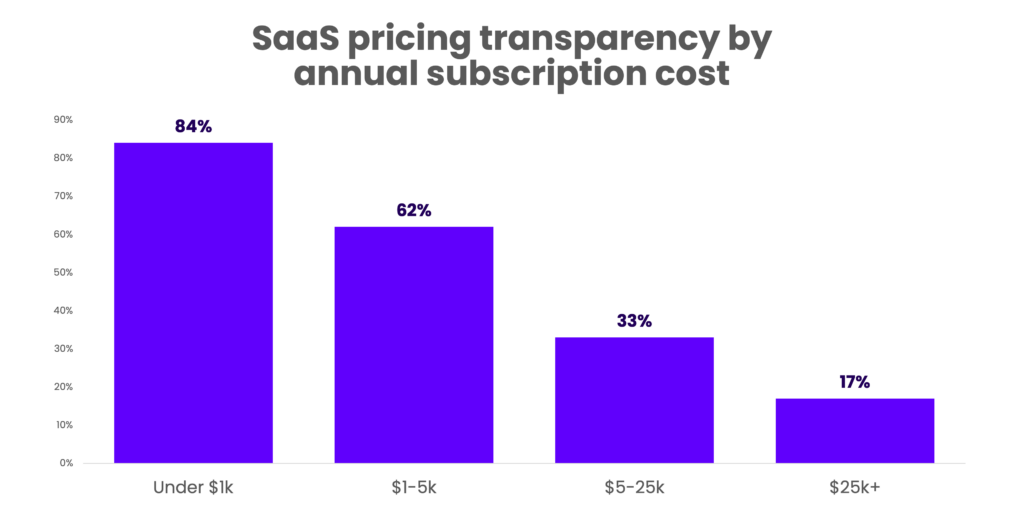

This sentiment is supported in the data. Truly fair pricing models would be variable, balanced to match the value received by the customer. Research from Process Street reveals that only 4% of software companies provide pricing on a sliding scale. Similarly, only 6% offer a guaranteed ROI, unpegging the cost of the product from the value it delivers. This is most evident at the enterprise level, where organizations are typically less price sensitive. Analysis of pricing transparency from Openview clearly shows that as pricing climbs towards the premium, the less likely a vendor is to include pricing in its marketing materials.

Only around one in six (17%) software vendors provide pricing for solutions that cost over $25,000 a year, making it almost impossible for businesses to compare options in the purchasing cycle for the software that matters.

Solving the problem of pricing transparency

When purchasing any software, research is an integral part of the process. This applies not only to functionality, but to pricing as well. Having a lack of visibility into pricing allows vendors to charge some customers a higher amount than others, based on how urgently that company needs the solution — bad news for the customer.

While discovering the official list price of a product is one thing (and seemingly a challenge to find with most SaaS vendors), understanding the expected discounting rate is another thing entirely. Certain vendors may stick strictly and firmly to their list price, yet others might be far more receptive to heavy negotiation tactics. Navigating this complicated landscape is, naturally, made much foggier with the opaque pricing policies that so many vendors typically employ.

“Put simply, customers need more information, not less, about business software in order to make informed decisions. Price is often the first thing a customer will look at when weighing their software options.“

– Vijay Sundaram, Chief Strategy Officer at Zoho Corporation

Sanjay Ghare, writing for Forbes, summarizes the particular pain of not having access to actual pricing benchmarks, regardless of list price availability. He says that while purchasing, customers want to be sure that the money they are paying is the same as what is paid by their industry counterparts. Many customers do not want to interact with sales teams — they want to evaluate and make decisions on their own time and schedules.

Negotiating the renewal of existing software is often more difficult than the initial purchase. Annual price hikes are standard procedure in SaaS. Doug Young, COO at The ASCII Group, estimates the average annual increase at between 5-10% — a number likely to rise amid spiking inflation rates. This is compounded by the perceived difficulty in switching vendors mid-cycle, with the leverage balanced much more heavily in the vendor’s favor than during the initial purchase.

It’s for these reasons and more that Vertice was founded. What TripAdvisor and Yelp have done for hotels and restaurants needs to be replicated in SaaS. Democratizing B2B software sales is long overdue.

Organizations working with Vertice can now get access to authentic, validated pricing insights from thousands of transactions, ensuring that they are getting the best possible deal on the business software they need for success. That value is likely to permeate, even if more vendors eventually opt for increased transparency in their pricing. When it comes to saving money and gaining visibility, there’s no such thing as too much.